Receive Alan's free Market Commentary every month and weekly educational videos (you can unsubscribe at any time).

Buy low - Sell high

The title of this article is a common phrase that everyone who has had any exposure to shares has heard at some point in their lives. It is a good way to approach buying a toaster or a new television but it is a bad way to approach share trading. I had a phone call from one of my Brokers back when Lend Lease fell out of its tree many years ago, suggesting that the price of the shares was very cheap. 'Lend Lease shares were at a bargain price and I should buy now'.

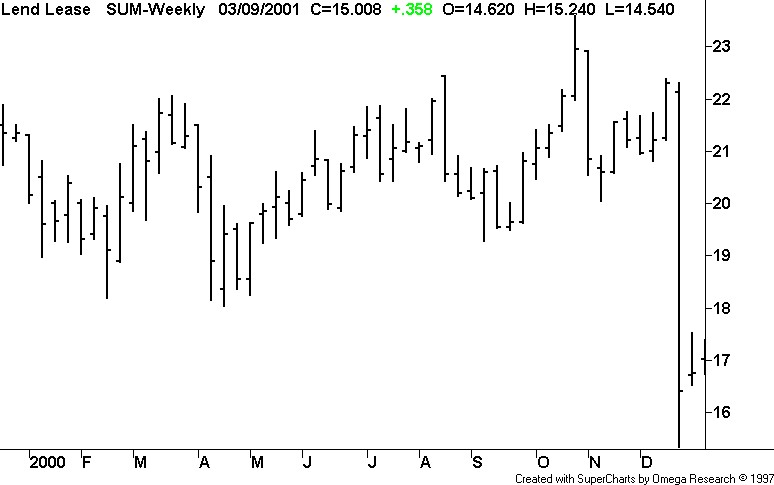

Lend Lease dropped from just over $22 to $17 on the back of bad news. Surely this is a low!

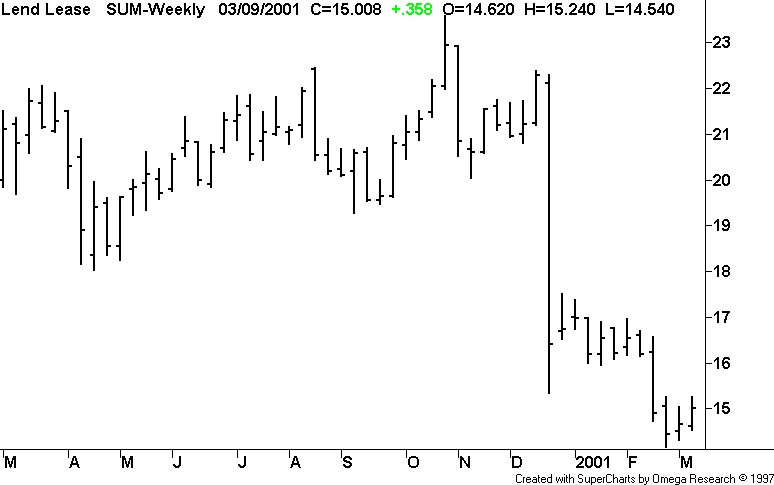

But 3 months on and it drops to $15 - surely this is a low and I should buy now - Lend Lease shares just have to rise from this price. But in fact Lend Lease shares fell even lower than $10.

The reality is that there is no such thing as a bargain priced share. A share's price is always the precise value that market participants collectively place on it at that exact moment in time. What the Broker is really saying is the sentiment is abnormally low and should improve from this point. The problem with this approach is that there is no telling when sentiment is likely to improve. The Broker has engaged in a guessing game of predicting market sentiment. Hence we have now departed from the science of probability and entered the world of prediction.

I know precisely how to measure market sentiment and that is how I trade the market. If a share price is rising then the market sentiment is positive and if the share price is falling then the market sentiment is negative. Hence…buy a rising share and sell a falling share. I do not dismiss what the Broker has told me and I will watch Lend Lease and buy when the share price has begun to rise. But the Broker's advice to buy when the price is still falling is flawed in logic.

I can only spot high's and low's with the benefit of hindsight and attempting to apply the theory of 'Buy low - sell high' in real time would mean analyzing the following type of chart. The reality of share trading is that you can't 'Buy low - sell high' unless you can see into the future.

As a chartist I observe historical data and deal with facts…I leave prediction to share traders who search for bargains and undervalued shares. Warren Buffet does not fall into this category because he is an asset manager, not a share trader. He wants to buy into undervalued companies and then work to improve their management, thus increasing their profitability. He then sits back and shares in the companies’ ongoing profits. His favorite holding time is forever and therefore captital growth is not his only concern. He is an investor as opposed to a trader…