Receive Alan's free Market Commentary every month and weekly educational videos (you can unsubscribe at any time).

Risk Rule

Risk management could easily be referred to as loss management

Managing losses makes you profitable

Successful market participants are successful because they focus on, and manage their losses. While fixating on profits is an enjoyable pastime, it will do little more than make you feel good for a time.

"A Risk Rule regulates our losses so that we can survive a string of losses and still be there when the market performs well."

Here's an explanation:

There are 3 key elements to manage when buying and selling shares. They are:

- The balance of probability

- The scale of payouts, i.e. the value of wins versus losses

- The size of our positions, i.e. how much we spend on each position

I don't want to confuse buying and selling with gambling, but it is helpful to illustrate my point with a game of chance - tossing a coin. Here's how the 3 elements apply to a game of coin toss:

- The balance of probability is even or 50-50 meaning an equal chance of getting heads or tails

- The scale of payouts is typically 1 to 1 as each player generally wagers the same as the other

- The size of positions are typically the same for each coin toss

Using the 3 elements described above there is an equal chance of winning or losing - it's considered a fair game. If we play it for long enough we should always breakeven.

Better than breakeven

But what if we changed the rules above in order to increase our chances of winning. The first element can't be changed because a coin is a coin and it will always offer a 50-50 chance of winning. It's unlikely that we can change the second element, an uneven payout scale, unless our opponent is really silly to accept one.

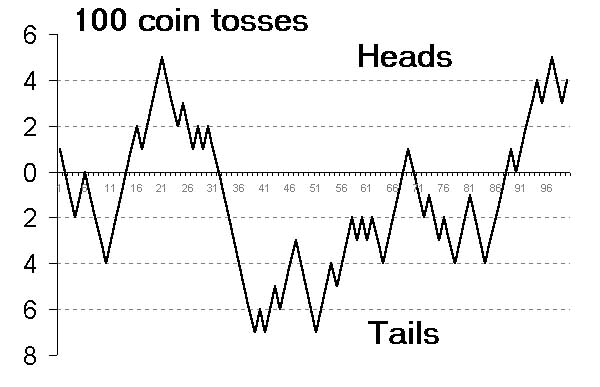

In fact, it is the 3rd element that we can manage to our advantage - position sizing. It's about surviving a string of losses. The chart below shows a possible outcome of 100 tosses. If we adjust the size of our wager so that can remain in the game long enough then after a string of wins we can leave the game with a profit.

Balance of outcomes for 100 coin tosses

Applying the concept to the stock market

Now let's look at the 3 elements in terms of investing in the stock market. The first element, the probability of success is actually tipped in our favour. If we were to randomly select a portfolio of blue chip shares and hold them for an indefinite period of time (assuming none of them de-listed), then the probable outcome would be the average performance of the stock market.

Given the good news that the market invariably rises over the long term, it is astonishing that the majority of people are not successful. The reason is the inability of most people to stay in the stock market long enough to exploit the law of averages. By simply surviving in the stock market we can achieve a positive results.

This is where our Risk Rule comes into play.

String of losses

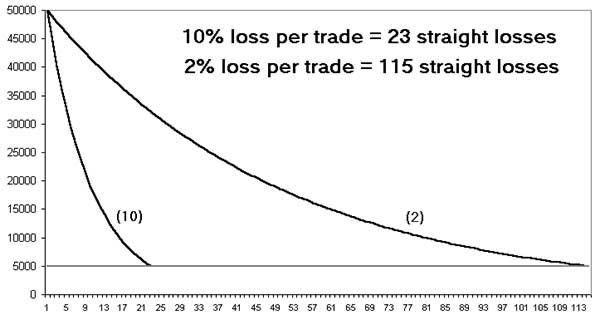

If you ask any experienced share trader, they'll tell you that even with a winning strategy it is quite common to suffer a string of up to eight consecutive losses. So to ensure long terms survival, we must regulate the size of our losses so that we can comfortably (read 'safely') sustain a string of repeated losses. We can achieve this by risking only a relatively small percentage of our total capital on each stock we buy.

The chart below shows two hypothetical equity curves. The steeper curve shows a string of losses when risking 10% of total capital per trade, and the shallower curve risks 2% of total capital per trade. The point is you would only last less than 25 trades using a 10% risk rule. By using the 2% risk rule you could sustain up to about 115 consecutive losses. Alan recommend using a 2% risk rule.

Stop losses

To apply the concept of the risk rule we must use stop losses. We can not manage our losses unless we are prepared to sell when the price is falling. A stop loss is a predefined level where, if reached, we are prepared to sell.

The difference between our entry price and the stop loss is the amount that we are risking in the trade. And this amount combined with our Risk Rule determines our position size. Here's an example:

- Total Capital = $50,000

- Risk Rule = 2%

- Entry Price = $12

- Stop Loss = $10

- Therefore, the potential loss per share = $12 - $10 = $2

- The amount we are prepared to lose = 2% of $50,000 = $1,000

- Therefore, the number of shares we can buy = $1,000 / $2 = 500

- Our position size is then = 500 x $12 = $6,000

Therefore, in this example, to limit our risk to 2% of Total Capital we must limit our position size to $6,000 worth of the shares and sell if the price falls to $10.

The 2% Risk Rule can be applied to any amount of capital and any share with the use of a stop loss.