Welcome to Alan's Overview Tour Part 1

A guided tour about investing in the stock market

Part 1 includes:

- Knowledge is valuable

- When to enter a Trend Trade (video)

- When to take profit in a Pennant Trade (video)

- What is the stock market

- What is share trading

Knowledge is valuable

By Alan Hull

Knowledge is valuable. Either someone else passes on knowledge to us or we discover it for ourselves, the latter approach usually involving some degree of pain.

A typical example is sticking your hand in a fire. I know I was told by my father not to stick my hand in the fire or I’ll get burnt but I was (and still am) the type of person who has to discover these sorts of dangers for myself.

When speaking publicly, I often say that I am in possession of what I know today because of the money I have lost in the market, not because of the money I have made.

I’ve stuck around because I have a high pain threshold psychologically and I’m extremely stubborn (psychology is a major aspect of investing). I have suffered in my life to work out what does work and what doesn't work, and I've found that sticking my hand in the fire will burn my fingers.

The stock market is very much like life in general where one learns what works by spending a great deal of time and energy working out what doesn’t work. I bought my first share when I was only eight years old, so I’ve spent a very large proportion of my life testing a very wide range of different investing styles and trading tactics. I’ve tried using tips and rumours, expert analysis from different gurus and media sources, piggybacking the likes of Kerry Packer and Warren Buffett and even cyclical analysis.

Here’s what I discovered…

All these techniques work and they don’t work. Their success depends largely on when you use them and so at some point all these different approaches will make you money but at some point they’ll also take it away again. It’s like the old saying about a broken watch being right twice a day...unless it works all the time, it’s useless. So it is with investing tactics; either they are universal in their application or they are effectively useless, not to mention costly.

There are a lot of broken watches out there when it comes to share trading and the first problem any newcomer to the stock market will encounter is the problem of sorting through so many choices when it comes to investing ideas, philosophies, systems and strategies. So to help you deal with all of these distractions and stay focused, I'm going to boiling it all down to two key facts.

My two key facts about the stock market

- Markets tend to trend

- Share prices cannot remain at rest indefinitely

I know these two observations sound ridiculously simple, and they are, but the reality I’ve discovered over many years is that any strategy based on them works and will most likely continue to work in the future. While there may be periods in the market when they don’t work, they can generally be treated as universal observations, or facts, when it comes to trading or investing.

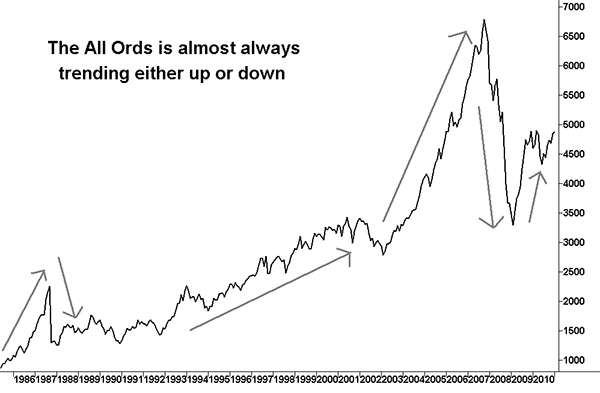

Markets tend to trend

This is probably the most obvious of these two observations and you don’t have to look very far to see this. Here is a long term chart of the Australian All Ordinaries index which is an aggregate of about 300 shares and is therefore representative of the behaviour of the Australian stock market in general. You can clearly see that the market has a strong tendency to trend either up or down for sustained periods of time. Of course this behaviour is also inherent to the individual shares that make up the All Ordinaries index as well.

To help with your understanding of trend trading please watch this short video (2:36 mins). In this Trading Technique episode Alan analyses a trend and discusses when to enter a trade.

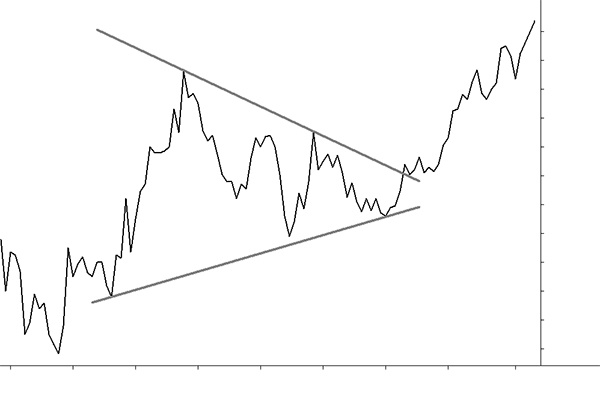

Markets cannot remain at rest indefinitely

Now to my second observation where I state that a share’s price cannot remain at rest indefinitely. In the following chart you can see how price activity consolidates down to what chartists call a point of agreement and then ‘breaks out’ from this point. Like trending, this is a commonly observed phenomenon when it comes to share price behaviour and one that traders can easily and reliably profit from by anticipating and then buying into the ensuing rally.

For an example of profit taking from a chart pattern please watch the following short video (2:16 mins).

To consistently take profits from the stock market, we need to employ a strategy or strategies that exploit these robust behavioural traits. Thus, from these two key observations comes all of my investing and trading systems. You'll get a taste of them throughout this tour. Like the observations they're based on, these trading systems are both robust and reliable.I'd love to say that these systems are as simple as the concepts behind them, but that would be somewhat misleading. A reality of investing is that some maths is involved and therefore it is an advantage if you are numerically literate.

But before we launch into the technical explanations, the next article provides a simple explanation on the basic question of 'What is the stock market?'

Continue reading Part 1 of the Tour: What is the stock market?