What is Share Trading

And, how is it different to investing?

Growth or dividends

"A simple explanation"

By Alan Hull

How to define share trading (or investing) is a very common point of confusion for many stock market participants including newcomers and even the more experienced, so I’m going to come at it from several directions in order to provide you with as much clarity as possible. Let’s start with a very simple explanation (with pictures of course).

The fortunes of a company will inevitably change over time, the price of the shares that represent a company will increase and decrease in sympathy with these changes.

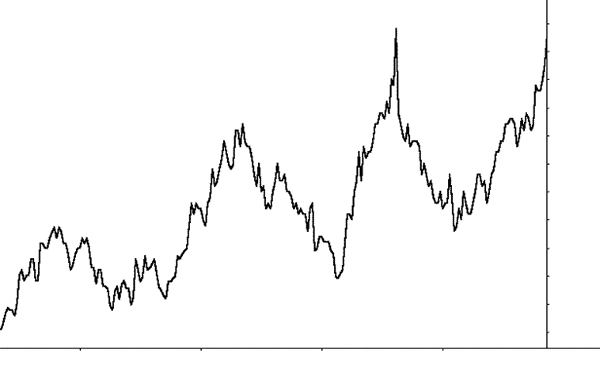

The chart below shows how share prices rise and fall over time.

It’s therefore possible to make money from buying and selling shares, providing you sell the share for a higher price than you paid for it. So while you own the share, the share’s price must increase.

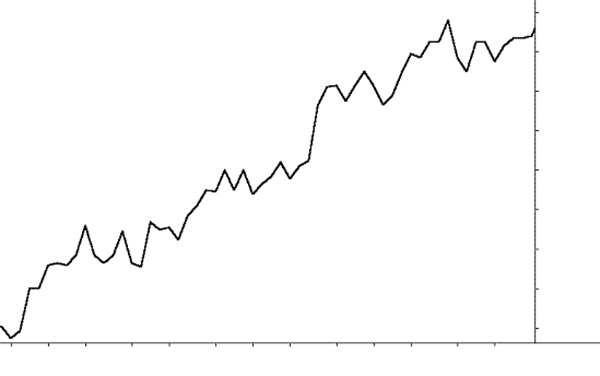

The following chart show a rising share price.

In investment circles this is given the fancy name of ‘capital growth’. It all sounds simple enough but so often people will confuse ‘trading’ with ‘investing’. So now I’m going to clarify the difference between these two distinctly different ways of dealing in shares.

Trading versus Investing

The word 'trade' means, 'buying and selling for profit' which does make for a useful definition. If I say I am a share trader then I am stating that I buy and sell shares for a profit which seems simple enough but there are deeper implications to this statement. For instance, if I am buying shares with the intention to sell them at a future date for a profit then I would have to be expecting them to rise in value.

Here’s the confusing bit, the word 'invest' means to, 'use money to make a profit' which includes any money making endeavour which requires money. So a share trader qualifies as a type of investor because they are applying money to the stock market in order to generate a profit. Contrary to popular belief, a person who deals in shares is not defined as a 'trader' by the number of trades they perform each year. This definition was created by a certain Government department and, whilst it may serve their purposes well, it is very misleading for the rest of us.

- Trade - 'buying and selling for profit'

- Invest - 'use money to make a profit'

The reality is, if you purchase a share with the intention to sell it at anytime in the future for a profit then you are a share trader. The value of the share must obviously go up whilst it is in your possession but you could sell it after 1 week, 1 year, 10 years or even longer. An stark example of a long-term trader is someone who purchases art and holds onto it across several generations before selling it. They may hold it for 100 years but they are still trading.

Warren Buffett is an Investor

So if we define a share investor as someone other than a share trader then I think it would be reasonable to take the world renowned Investor, Warren Buffet's, definition of an investor as being an 'Asset manager'. Warren Buffett's company, Berkshire Hathaway, is an asset management company which buys interests in companies that are undervalued, improves their operation over time and then derives a return from them via the company’s increased profits.

Warren Buffett's favourite holding time is forever because he buys into companies in order to derive an ongoing interest in their operation and not to sell their stock at some point in the future for capital growth. Believe me, Warren Buffett is very clear on what he’s doing!

In other words, he's primarily after a share of the ongoing profits and he views any capital growth largely as a bonus. Furthermore, in order to make use of any capital growth he will borrow against it rather than sell his holdings which will attract capital gains tax. Unlike a share trader who will sell shares that start to fall in value, Warren will buy more shares because they represent a cheaper income stream.

So a share trader wants to buy a rising share price and an investor (read: asset manager) wants to buy a high income yield which occurs when the share price falls…perfectly opposed objectives! Here’s a numeric example to help clarify Warren’s perspective;

Numeric Example

- Let's assume that a company pays an annual dividend of $1.00 and the share price is $10.00

- Hence the dividend yield or income yield = $1.00 / $10.00 = 10% per annum

- Now let's assume the share price drops to $8.00 but the dividend remains at $1.00 per annum, a not unlikely occurrence given that a company's profitability isn't necessarily linked to its share price

- Therefore the dividend yield would increase to = $1.00 / $8.00 = 12.5% per annum

So if you're an investor like Warren Buffett and looking to buy a high yielding stock, then the direction of the share price is largely irrelevant because, like Warren, you have no intention of selling the share at a later date. In fact, if the share price was to halve during a stock market crash you would buy more shares because the yield will have doubled.

On the other hand, if you’re a share trader then you want the share price to be rising and so you can see why it’s so important that you don’t confuse trading and investing. And whilst you can be both an investor and a trader, it is imperative that you keep these two different activities completely separate.

We hope you have enjoyed Part 1 of Alan's Overview Tour!

In the next part, we will discuss taking control with Active Investing. Look for Part 2 in your inbox soon!

Previous articles in the tour: