How to finesse your entry

There can be benefits to tweaking your market entry

It's not necessary to always do so but sometimes you may like to follow the guidelines below

Given the level of enquiries on this topic there is obviously a fair degree of interest in how to go about finessing your market entry.

There are several ways you can do it ranging from the simple and obvious to the more sophisticated techniques.

Average your entry

This first strategy is designed to make sure you don't buy your shares at the highest price of the week or sell at the lowest price. To ensure this doesn't happen to you, simply buy or sell your shares in two or three parcels.

Let's say you want to buy $60,000 worth of XYZ shares next week. So you buy $20,000 on Monday, $20K on Tuesday and $20K on Wednesday.

Using this simple approach it is almost (but not quite) guaranteed that you will never buy shares at the top of the market nor sell them at the bottom. The catch is that you will also never buy them at the lowest price nor sell at the highest price.

It's a double edged sword but if you've ever sold at the low for the week then you'll know the frustration it causes when the market recovers.

Build your portfolio slowly

This is an extension of 'averaging your entry' where you spread out building your portfolio over several weeks. This is in fact the method Alan prescribes in the Blue Chip Report where he recommends building your 10 position growth portfolio by buying only 2 to 3 positions each week. And refraining from buying altogether if you suddenly see the market start to fall.

When the market starts to rise again then you can resume building your portfolio. There is the conventional wisdom that says to buy into short term weakness but this should be tempered to buy once you see the market start to rise again. Don't buy into a market while it is actually falling as you will be catching a falling dagger...to quote an old cliché.

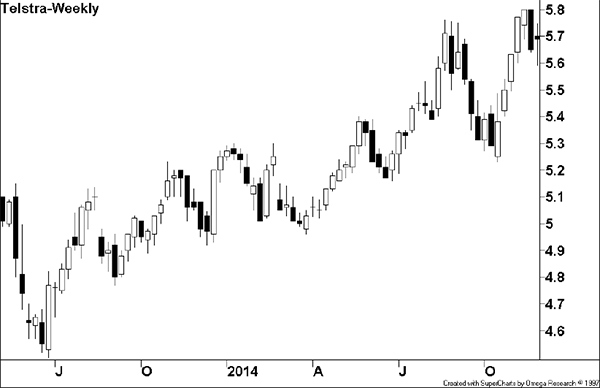

Enter on an upweek

In a similar vein but on a smaller scale, only buy a share if it has had an upweek. This technique will prevent you from buying into a market that has begun to rally downwards. Note in the chart below how the down weeks (black bars) tend to occur in runs. So wait for buyer support.

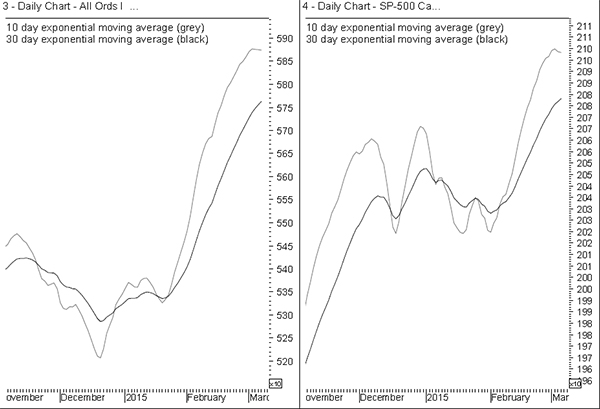

Index crossover charts

You've probably started to see a common theme here and it continues with this technique: index crossover charts. These are part of the Active Investing strategy and are so you do not buy shares unless at least one of the following charts has its two moving averages crossed to the upside. One of these charts is the Australian All Ordinaries index and the other one is the US SP-500 index. And this can be modified to require both charts to be crossed upwards.

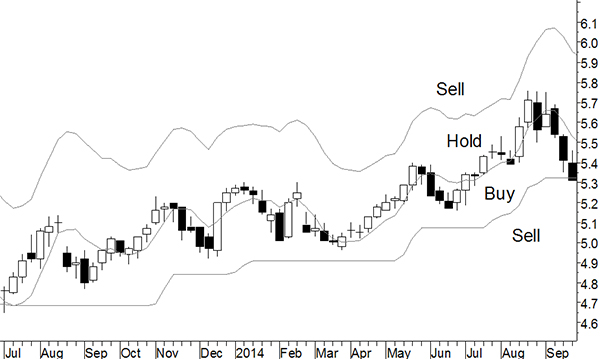

Wait for a pullback

This last technique is incorporated into Alan's Range Indicator from the Active Investing strategy which defines buy, hold and sell zones on a price chart using three almost parallel lines. The idea is that you can only buy into a trending share when the price activity is in a pullback. And even then you have to wait for an upweek before you can actually pull the trigger. This is the most sophisticated approach Alan recommends.

Buy alas, nothing is full proof and you may wait for a pull back in a share that never occurs, as it may take off on you. Thus there are pros and cons to all these techniques and whilst Alan's trading systems do employ entry techniques, they are not mission critical to the success of any of these systems. What is critical is the underlying philosophy of the trading system. However, if you are inclined to want to finesse your market entry these methods provide you with some workable solutions.