How to leapfrog strategies

Changing up from a shorter term strategy to a longer term one

This articles explains how Alan's trading strategies fit together in a holistic manner

Two questions we get asked a lot include

"Which of Alan's strategies should I use?"

"How do they all fit together?"

These are good questions and ones which will be answered in this article.

Each strategy does have a unique purpose in the stock market and the strategies do fit together in a way where they can be used concurrently.

Here how!

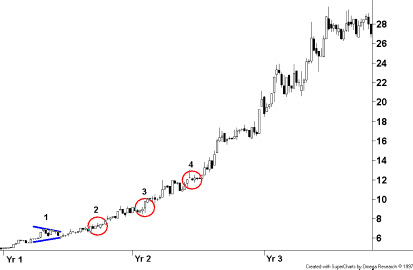

If you look at a chart of a really long term trend, you can mark on it where each of Alan's four PDF newsletters would apply. At the start of a trend the first thing you will probably see is a break out. Then the trend develops over time and our confidence also increases over time.

1. Breakout Trading newsletter

The first newsletter you would see the above share appear in is the Breakout Trading newsletter. At this point there is no trend and therefore we are fairly uncertain of how the situation is likely to develop.

We aren’t interested in the long term picture at this stage and so the underlying fundamentals are largely irrelevant. But rather, we simply want to pounce on this early movement and try to take a quick profit. Hence the Breakout Trading newsletter is classified as medium risk, employs tight stop losses and requires close monitoring. If a breakout trade goes against you then you need to act quickly.

2. Active Trading newsletter

Next comes my Active Trading strategy which is a short term trend trading system. As the energy from the initial break out fades, sometimes the share will then settle into a trending pattern. It’s still relatively early days with the trend only 2 to 3 months old and so once again fundamental analysis doesn’t play a very significant role.

Although our confidence in the developing trend is growing, this strategy is also medium risk, employs tight stop losses and requires close monitoring. Interestingly this strategy was introduced because of demand for a more aggressive version of my Active Investing approach.

3. Active Investing newsletter

At point 3 we come to the Active Investing strategy and Alan's original newsletter service. He first published the Active Investing newsletter in mid 2000 and it was (and still is) based on a combination of fundamental and technical analysis. It identifies medium term trends from 6 months duration and at this stage of trend development, fundamental analysis becomes relevant.

We want to know that a trend has staying power and is likely to last for at least a year. On this basis we need to ensure we are dealing with a fundamentally sound share and not just some short term trend that’s based on a takeover rumour or some similar unfounded market sentiment.

This strategy is low risk as we now have considerable confidence in the trend. Therefore we can manage an Active Investing portfolio with wider stop losses and monitor it on a weekly basis.

The Active Investing strategy predominately identifies blue and green chip shares and they are typically low volatility. The drawback with this system however is that it requires some chart interpretation and will identify some shares with marginal liquidity. This will suit some investors but not everyone.

4. Blue Chip Report

So last on the list is the Blue Chip Report which is the Active Investing newsletter’s big brother. This is a medium to long term blue chip portfolio management system that uses a very robust and easy to use strategy. It is also our premium service and includes weekly market commentary which Alan writes every week, giving his most up-to-date market analysis and detailed recommendations.

Leapfrogging

Now to how they fit together. If you buy a share that appears on the Breakout Trading newsletter and then it appears on the Active Trading newsletter shortly thereafter, you can switch your trade management to the latter newsletter if you wish. Similarly if it appears on the Active Investing newsletter and drops off Active Trading newsletter then you can leapfrog up to the Active Investing newsletter.

Finally you can also do the same with the Active Investing newsletter and the Blue Chip Report. It is however important to remember that you should only progress up through the newsletters and not the other way. Thus these 4 newsletters provide a vertical solution to growth management.

If you would like to read more about each strategy click on the links below...

A Platinum subscription will give you all 4 PDF newsletters for one low annual fee. If you are interested in the Platinum offer please click the link to contact us for the details.

Click here for more articles and videos